Delving into How to Lower Your Car Finance Monthly Payment Legally, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Understanding the intricacies of car finance and exploring strategies to reduce monthly payments legally is crucial for financial stability. Let's dive into the key aspects that can help you navigate this process effectively.

Understanding Car Finance

Car finance is a way to purchase a vehicle through a loan or lease agreement. It allows individuals to spread out the cost of a vehicle over time, making it more affordable for those who may not have the full amount upfront.

Components of a Car Finance Agreement

- The Principal Amount: This is the total amount borrowed to purchase the vehicle.

- Interest Rate: The percentage charged by the lender for borrowing the money.

- Loan Term: The length of time over which the loan is repaid.

- Monthly Payment: The amount to be paid each month towards the loan.

Importance of Understanding Terms and Conditions

It is crucial to thoroughly understand the terms and conditions of a car finance agreement to avoid any surprises or hidden fees. Knowing your obligations and rights can help you make informed decisions and prevent any financial pitfalls in the future.

Types of Car Finance Options

- Hire Purchase: The buyer pays an initial deposit and then makes fixed monthly payments until the full amount is paid off.

- Personal Contract Purchase (PCP): Similar to a lease, the buyer pays monthly installments with the option to purchase the vehicle at the end of the term.

- Personal Loan: Borrowing a set amount from a bank or lender to buy the vehicle outright.

Factors Affecting Monthly Payments

When it comes to car finance, several factors play a crucial role in determining your monthly payments. Understanding how these factors influence your payments can help you make informed decisions and potentially lower your monthly expenses.

Interest Rates

Interest rates have a significant impact on your monthly car finance payments. A higher interest rate means you'll pay more in interest over the life of the loan, increasing your monthly payments. Conversely, a lower interest rate can reduce your monthly payment amount.

Loan Amount

The total amount of the loan you take out to finance your car directly affects your monthly payments. A larger loan amount will result in higher monthly payments, while a smaller loan amount will lead to lower monthly payments.

Loan Term

The duration of your loan term also plays a crucial role in determining your monthly payments. A longer loan term typically results in lower monthly payments but may lead to paying more in interest over time. On the other hand, a shorter loan term can increase your monthly payments but reduce the total interest paid.

Other Factors

In addition to interest rates, loan amount, and loan term, several other factors can influence your monthly car finance payments. These include your credit score, down payment amount, trade-in value, and any additional fees or add-ons included in the loan agreement.

It's essential to consider all these factors when evaluating your monthly payment options.

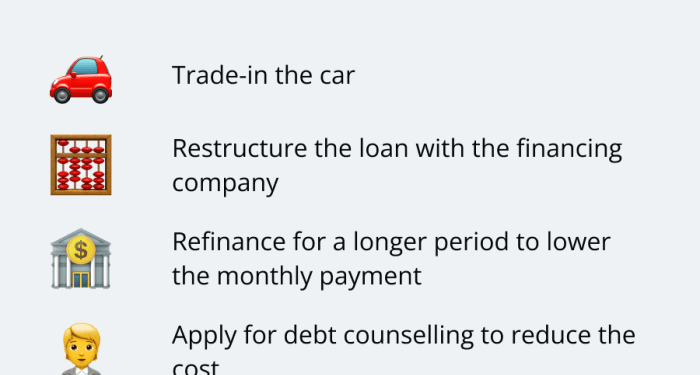

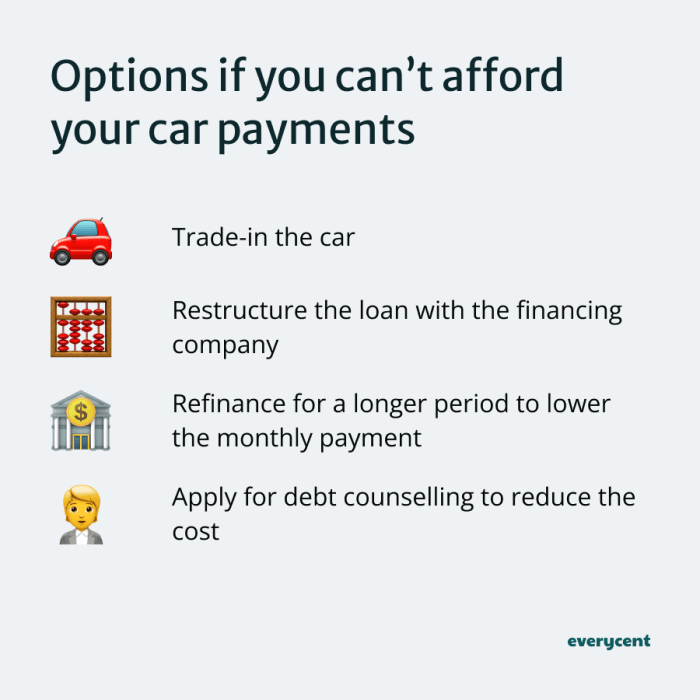

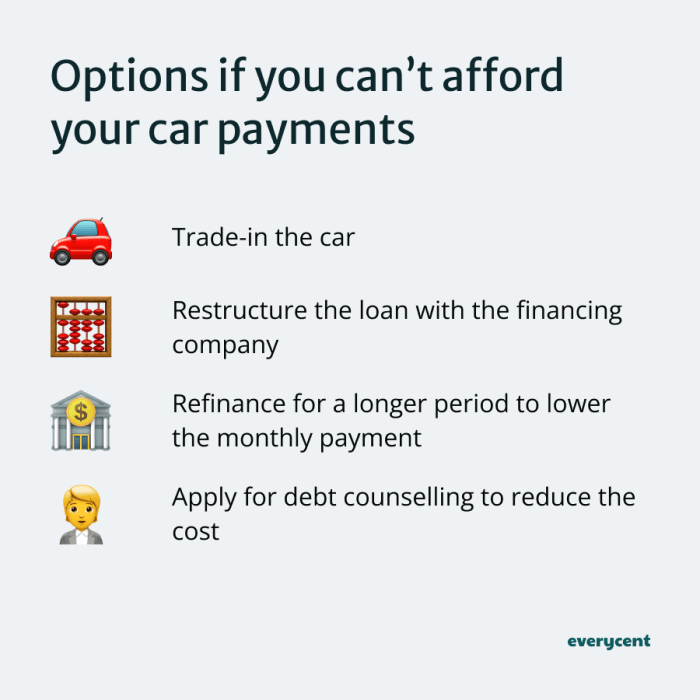

Strategies to Lower Monthly Payments

When it comes to lowering your car finance monthly payment, there are several strategies you can consider to help ease the financial burden

Refinancing a Car Loan

Refinancing your car loan can be a viable option to lower your monthly payments. By refinancing, you may be able to secure a lower interest rate or extend the loan term, both of which can result in reduced monthly payments.

It's important to shop around for the best refinancing options and consider any associated fees.

Negotiating with the Lender

Another strategy to lower your monthly payments is to negotiate with your lender for lower interest rates. If you have a good payment history or improved credit score since taking out the loan, you may have leverage to negotiate a better rate.

Be prepared to provide documentation to support your case.

Increasing the Down Payment

Increasing your down payment when purchasing a car can also help reduce your monthly payments. A larger down payment means borrowing less money, resulting in lower monthly installments. Consider saving up for a larger down payment before purchasing your next vehicle to help lower your monthly financial commitment.

Trading in a Vehicle

Trading in your current vehicle when purchasing a new one can potentially lower your monthly payments. The trade-in value can be used as a down payment on the new car, reducing the amount you need to finance. Make sure to research the trade-in value of your current vehicle to ensure you are getting a fair deal.

Legal Considerations

When it comes to modifying a car finance agreement, there are important legal implications to consider. Any changes made to the terms of the agreement should be done with the consent of the lender to avoid breaching the contract. It is essential to understand the consequences of missing or defaulting on car finance payments, as this could lead to repossession of the vehicle and damage to your credit score.

Legal Options for Lowering Monthly Payments

- Requesting a loan modification: Some lenders may be willing to adjust the terms of the agreement to lower your monthly payments. This could involve extending the loan term or reducing the interest rate.

- Refinancing the loan: Another legal option is to refinance the car loan with a different lender to secure a lower interest rate and decrease your monthly payments.

- Seeking financial assistance programs: There are government programs and non-profit organizations that offer assistance to individuals struggling with car loan payments. These programs can help lower your monthly payments without violating the terms of the agreement.

Final Summary

In conclusion, mastering the art of lowering your car finance monthly payment legally can lead to significant savings and financial peace of mind. By understanding the legal considerations and implementing effective strategies, you can take control of your car finance and optimize your monthly payments.

Clarifying Questions

Can I lower my car finance monthly payment without renegotiating the loan terms?

Yes, you can explore options like refinancing, increasing your down payment, or trading in your vehicle to lower your monthly payments without renegotiating the loan terms.

What legal implications should I consider when trying to lower my car finance monthly payment?

It's important to understand the legal consequences of modifying your car finance agreement and ensure that any adjustments made are within the confines of the law to avoid breaching the agreement.

Is missing a car finance payment a serious issue?

Missing car finance payments can have serious consequences, including damaging your credit score and potentially leading to default. It's crucial to prioritize timely payments to avoid these repercussions.

data-ad-client="ca-pub-1784768207398293" data-ad-slot="7141627725" data-ad-format="auto" data-full-width-responsive="true">Delving into How to Lower Your Car Finance Monthly Payment Legally, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Understanding the intricacies of car finance and exploring strategies to reduce monthly payments legally is crucial for financial stability. Let's dive into the key aspects that can help you navigate this process effectively.

Understanding Car Finance

Car finance is a way to purchase a vehicle through a loan or lease agreement. It allows individuals to spread out the cost of a vehicle over time, making it more affordable for those who may not have the full amount upfront.

Components of a Car Finance Agreement

- The Principal Amount: This is the total amount borrowed to purchase the vehicle.

- Interest Rate: The percentage charged by the lender for borrowing the money.

- Loan Term: The length of time over which the loan is repaid.

- Monthly Payment: The amount to be paid each month towards the loan.

Importance of Understanding Terms and Conditions

It is crucial to thoroughly understand the terms and conditions of a car finance agreement to avoid any surprises or hidden fees. Knowing your obligations and rights can help you make informed decisions and prevent any financial pitfalls in the future.

Types of Car Finance Options

- Hire Purchase: The buyer pays an initial deposit and then makes fixed monthly payments until the full amount is paid off.

- Personal Contract Purchase (PCP): Similar to a lease, the buyer pays monthly installments with the option to purchase the vehicle at the end of the term.

- Personal Loan: Borrowing a set amount from a bank or lender to buy the vehicle outright.

Factors Affecting Monthly Payments

When it comes to car finance, several factors play a crucial role in determining your monthly payments. Understanding how these factors influence your payments can help you make informed decisions and potentially lower your monthly expenses.

Interest Rates

Interest rates have a significant impact on your monthly car finance payments. A higher interest rate means you'll pay more in interest over the life of the loan, increasing your monthly payments. Conversely, a lower interest rate can reduce your monthly payment amount.

Loan Amount

The total amount of the loan you take out to finance your car directly affects your monthly payments. A larger loan amount will result in higher monthly payments, while a smaller loan amount will lead to lower monthly payments.

Loan Term

The duration of your loan term also plays a crucial role in determining your monthly payments. A longer loan term typically results in lower monthly payments but may lead to paying more in interest over time. On the other hand, a shorter loan term can increase your monthly payments but reduce the total interest paid.

Other Factors

In addition to interest rates, loan amount, and loan term, several other factors can influence your monthly car finance payments. These include your credit score, down payment amount, trade-in value, and any additional fees or add-ons included in the loan agreement.

It's essential to consider all these factors when evaluating your monthly payment options.

Strategies to Lower Monthly Payments

When it comes to lowering your car finance monthly payment, there are several strategies you can consider to help ease the financial burden

Refinancing a Car Loan

Refinancing your car loan can be a viable option to lower your monthly payments. By refinancing, you may be able to secure a lower interest rate or extend the loan term, both of which can result in reduced monthly payments.

It's important to shop around for the best refinancing options and consider any associated fees.

Negotiating with the Lender

Another strategy to lower your monthly payments is to negotiate with your lender for lower interest rates. If you have a good payment history or improved credit score since taking out the loan, you may have leverage to negotiate a better rate.

Be prepared to provide documentation to support your case.

Increasing the Down Payment

Increasing your down payment when purchasing a car can also help reduce your monthly payments. A larger down payment means borrowing less money, resulting in lower monthly installments. Consider saving up for a larger down payment before purchasing your next vehicle to help lower your monthly financial commitment.

Trading in a Vehicle

Trading in your current vehicle when purchasing a new one can potentially lower your monthly payments. The trade-in value can be used as a down payment on the new car, reducing the amount you need to finance. Make sure to research the trade-in value of your current vehicle to ensure you are getting a fair deal.

Legal Considerations

When it comes to modifying a car finance agreement, there are important legal implications to consider. Any changes made to the terms of the agreement should be done with the consent of the lender to avoid breaching the contract. It is essential to understand the consequences of missing or defaulting on car finance payments, as this could lead to repossession of the vehicle and damage to your credit score.

Legal Options for Lowering Monthly Payments

- Requesting a loan modification: Some lenders may be willing to adjust the terms of the agreement to lower your monthly payments. This could involve extending the loan term or reducing the interest rate.

- Refinancing the loan: Another legal option is to refinance the car loan with a different lender to secure a lower interest rate and decrease your monthly payments.

- Seeking financial assistance programs: There are government programs and non-profit organizations that offer assistance to individuals struggling with car loan payments. These programs can help lower your monthly payments without violating the terms of the agreement.

Final Summary

In conclusion, mastering the art of lowering your car finance monthly payment legally can lead to significant savings and financial peace of mind. By understanding the legal considerations and implementing effective strategies, you can take control of your car finance and optimize your monthly payments.

Clarifying Questions

Can I lower my car finance monthly payment without renegotiating the loan terms?

Yes, you can explore options like refinancing, increasing your down payment, or trading in your vehicle to lower your monthly payments without renegotiating the loan terms.

What legal implications should I consider when trying to lower my car finance monthly payment?

It's important to understand the legal consequences of modifying your car finance agreement and ensure that any adjustments made are within the confines of the law to avoid breaching the agreement.

Is missing a car finance payment a serious issue?

Missing car finance payments can have serious consequences, including damaging your credit score and potentially leading to default. It's crucial to prioritize timely payments to avoid these repercussions.

data-ad-client="ca-pub-1784768207398293" data-ad-slot="7141627725" data-ad-format="auto" data-full-width-responsive="true">